If all or part of an invoice appears to be uncollectible, you can "write off" (or "charge off") that amount such that the invoice no longer shows up on your Accounts Receivable aging report. The majority of this process is handled within QuickBooks Online and is described below.

Step 1: Determine whether QuickBooks Online is using an Accrual or Cash basis of accounting

With cash-based accounting, your company recognizes income when payments are received from clients. With accrual accounting, income is recorded when it is earned (typically when you invoice the client). With a cash-based business, you don't necessarily need to write off the uncollectible amount because you haven't recognized that revenue yet. You could simply reduce the amount of the invoice or delete the invoice altogether if the entire invoice will not be paid. With an accrual-based business, you must write off the uncollectible amount to a Bad Debt account to offset the previously recognized revenue.

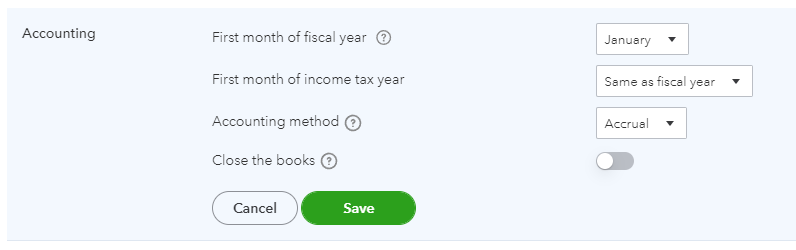

To determine if QuickBooks Online is in Accrual or Cash mode, just click on the Settings wheel, then select Accounts and Settings, and finally choose the Advanced menu option. Within the Accounting section of the screen, identify the accounting method that is in use. If you are using a Cash basis, you may choose to just reduce the amount of the invoice rather than proceed with the steps below.

Step 2: Create a Bad Debt account in QuickBooks Online

When you write off all or part of an invoice, you need to capture the amount as a charge to a Bad Debt account. This is needed in order for the amount to show up as an expense on the Income Statement. With accrual accounting, the amount has likely previously been recognized and should now be offset by a Bad Debt expense.

It is quite likely that your company's QuickBooks Online instance already has a Bad Debt account. To determine this, just click on the Settings wheel and then select Chart of accounts. From here, just type in "Bad" into the Filter by name textbox to see if the Bad Debt account already exists. If it does, you can skip to the next step.

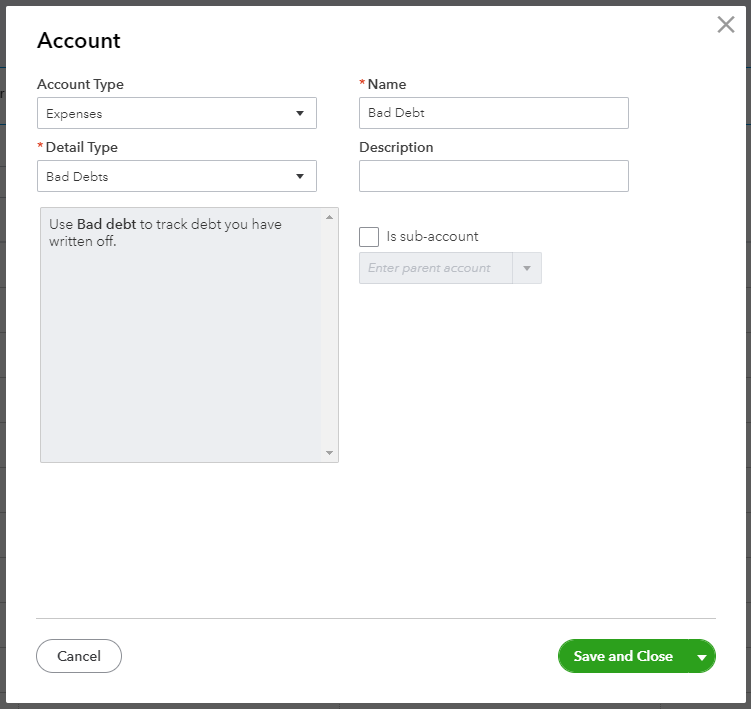

If the Bad Debt account does not exist, just click the New button to bring up the Account window. Select "Expenses" as the Account Type and "Bad Debts" as the Detail Type. Then, name the new account "Bad Debt" as shown below and click the Save and Close button.

Step 3: Create a Product/Service Item in QuickBooks for Bad Debt

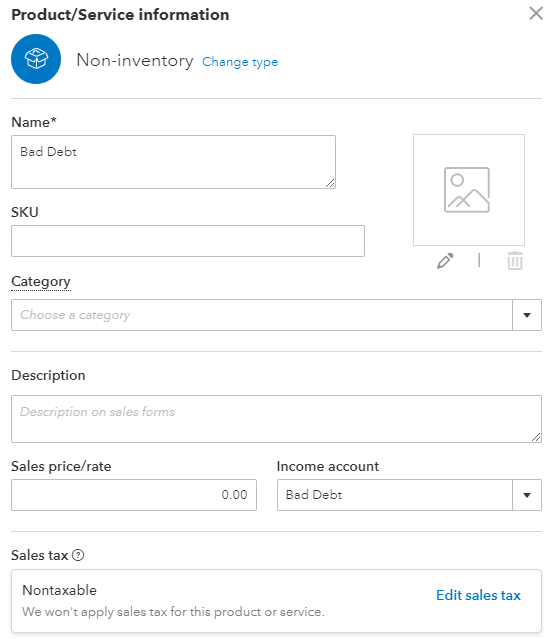

Within QuickBooks, click on the Settings wheel and then select the Product and services menu option. Click the New button and choose Non-inventory as the type. Next, type in "Bad Debt" for the Name and in the Income account drop-down select the Bad Debt account you created in the previous step.

Step 4: Create a Credit Memo

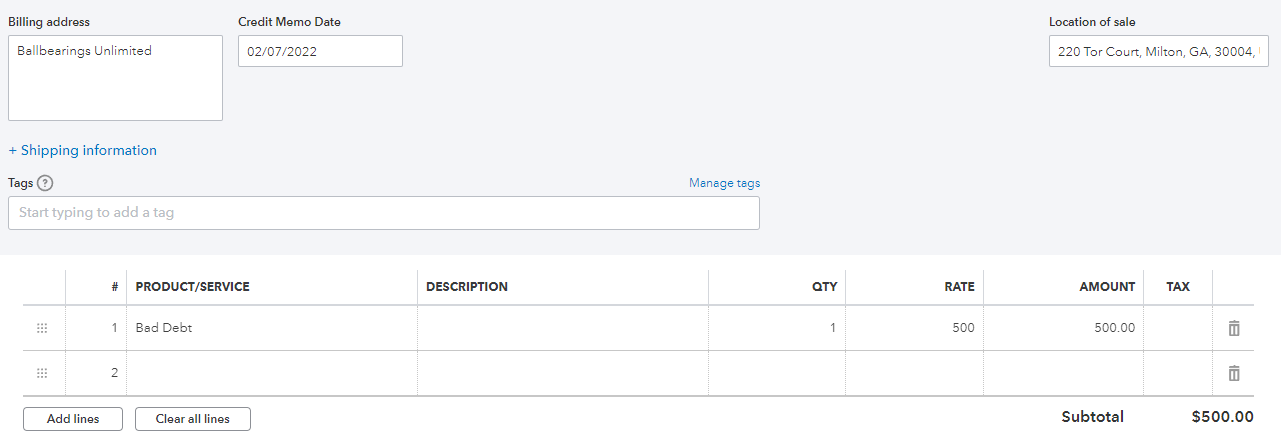

The next step is to create a Credit Memo for the client associated with the invoice that you will be writing off. To create a credit memo, click the + New button and select Credit memo. Select the QuickBooks customer at the top-left of the Credit Memo form and then select Bad Debt in the Product/Service column. Then simply type in the amount you wish to write off and click the Save and close button.

Step 5: Validate the Payment that QuickBooks Automatically Created

When the credit memo is saved, QuickBooks will automatically apply that memo to an outstanding invoice for that customer as a payment. If you only have one outstanding invoice, then the credit will be appropriately applied to that invoice. But, if you have multiple outstanding invoices for that customer, it is possible that QuickBooks will apply the credit memo to the wrong invoice.

To verify that the credit memo was used to pay the correct invoice, click on Invoicing main menu option and then select All Sales. From this list, click on the zero dollar payment that will show up immediately next to the Credit Memo in the list. Note that this payment will have a note that says "Created by QB Online to link credits to charges."

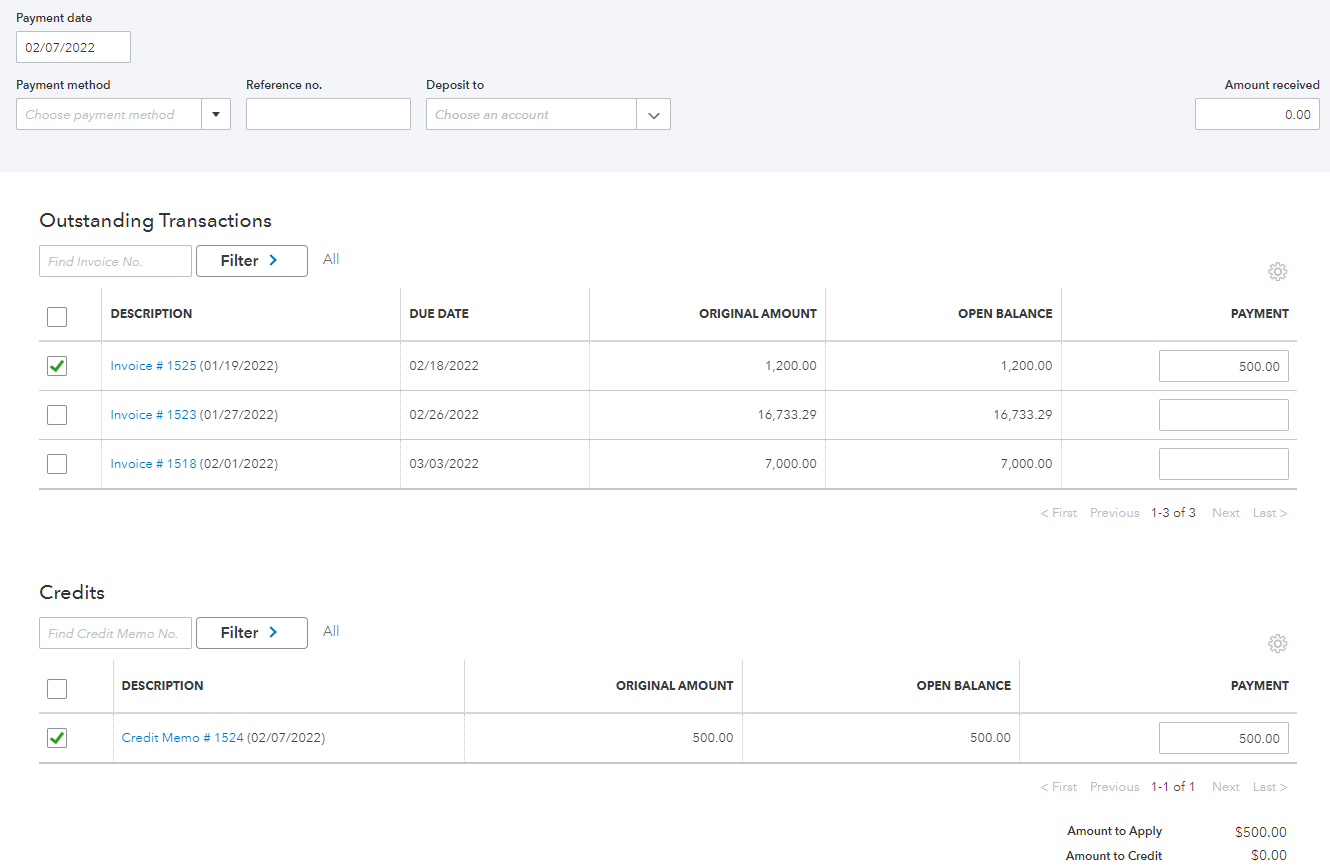

This screen will show you how the credit was applied to the invoices for that Client. If the credit was not applied correctly, you can simply adjust the application of the credit within the Outstanding Transactions section of the screen and then click Save and close.

If the invoice to which the credit was applied is synched with Ruddr, QBO will send the credit to Ruddr as a payment. The payment will show a $0.00 "amount received", but will also update the outstanding balance on the invoice to reflect the updated balance after the credit has been applied.

Step 6: Confirm the Bad Debt Amount on the Income Statement

To ensure that the invoice amount was properly written off to Bad Debt, run an Income Statement for the period that includes the write off. You should see a Bad Debt amount within the Expenses section of the Income Statement that matches the amount of the Credit Memo that you created.